sales tax on food in chattanooga tn

During the period beginning at 1201 am on Monday August 1 2022 and ending. This is the total of state county and city sales tax rates.

1950s Mullins Cove Restaurant The South S Finest Foods Chattanooga Tn Postcard Ebay

I was wondering about the sales tax in Chattanooga TN.

. During the period beginning at 1201 am on Monday August 1 2022 and ending Wednesday August 31 2022 at 1159 pm food and food ingredients are exempt from sales tax. You can also email revenuesupporttngov or call 615-253-0600 with. Tennessee will have three sales tax holidays in 2022.

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Chattanooga Tennessee is. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The state sales tax holiday on food and food ingredients begins August 1 and lasts the whole month. What is the sales tax rate in Chattanooga Tennessee. Several examples of of items that exempt from Tennessee.

The County sales tax rate is. Manager - Sales Use Tax. Tennessee has recent rate.

The Tennessee state sales tax rate is currently. The December 2020 total local sales tax rate was also 9250. 31 rows The latest sales tax rates for cities in Tennessee TN state.

31 rows Chattanooga TN Sales Tax Rate. What is the sales tax rate in Chattanooga Tennessee. The current total local sales tax rate in Chattanooga TN is 9250.

Lee Proposes Suspension of Grocery Sales Tax in Tennessee State tax would be withheld for 30 days. There is no applicable city tax or special tax. You can print a 925.

The 925 sales tax rate in Chattanooga consists of 7 Tennessee state sales tax and 225 Hamilton County sales tax. I understand there is tax on food in Chattanooga what about across the border in Georgia. The Tennessee sales tax rate is currently.

Job in Chattanooga - Hamilton County - TN Tennessee - USA 37450. The minimum combined 2022 sales tax rate for. Food in Tennesse is taxed at 5000 plus any local taxes.

The December 2020 total local sales tax rate was also 9250. The Chattanooga sales tax rate is. Chattanooga residents ready for sales tax holidays.

Wednesday July 6 2022. Tennessee to Suspend Sales Tax on Food in August. 31 rows With local taxes the total sales tax rate is between 8500 and 9750.

Food in Tennesse is taxed at 5000 plus any local taxes. Food City Governor Bill Lee Grocery inflation local food taxes. Sales taxes on food in Tennessee resume Thursday after August moratorium Bargain shoppers load up on nontaxed food items before the end of the month August 30.

The general state tax rate is 7. The Tennessee General Assembly approved two additional one-time holidays this year in addition.

Tennessee Plans Sales Tax Holiday Adds Tax Free Restaurant Sales Weekend

/cloudfront-us-east-1.images.arcpublishing.com/gray/5YXZBGUB2JOFHMEMQXP2BPHUCI.jpg)

Tax Free In Tennessee Save On Food Items This Week

Yet Again Tennessee Combined State Local Sales Tax Rates Nation S Highest Chattanooga Times Free Press

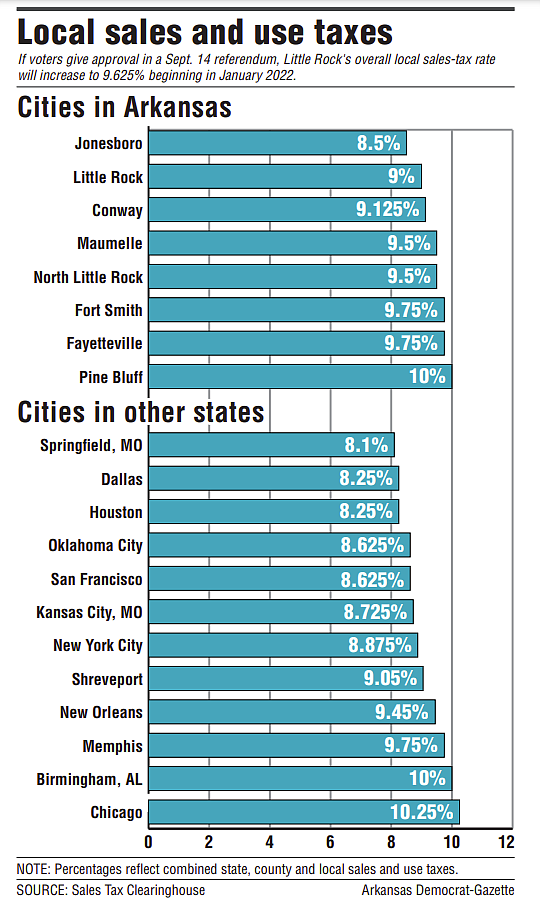

As Tax Rates Go Arkansas At Top

Sales Taxes On Food In Tennessee Resume Thursday After August Moratorium Chattanooga Times Free Press

Tennessee Back To School Sales Tax Free Weekend Kicks Off Wtvcfox

The Saga Of Our Dinner Picture Of Ruth S Chris Steak House Chattanooga Tripadvisor

Food Sales Tax Exemption Ff 08 10 2020 Tax Policy Center

The Pickle Barrel Restaurant Matchbook 1012 Market St Chattanooga Tn Rare Ebay

Tennessee Bill Would Exempt Groceries From Sales Tax For May Through October 2021 Wbir Com

Tennessee Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Opinion Grocery Tax Suspension Will Give Tennesseeans A Break But What Happens When It S Over Chattanooga Times Free Press

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

Restaurants Of Yesteryear Featured In Chattanooga In Old Photos Chattanoogan Com

Chattanooga Tennessee Wikipedia

How Are Groceries Candy And Soda Taxed In Your State

Asia Cafe Chattanooga Restaurant Reviews Photos Phone Number Tripadvisor

/cloudfront-us-east-1.images.arcpublishing.com/gray/CEQDJLEQ3JAMTLOT4DUDSOID3A.jpg)