how to calculate cost of stock

First in first out is a simple way to. R D1Po g D1 5 Po 100 g 17 r 510017 22.

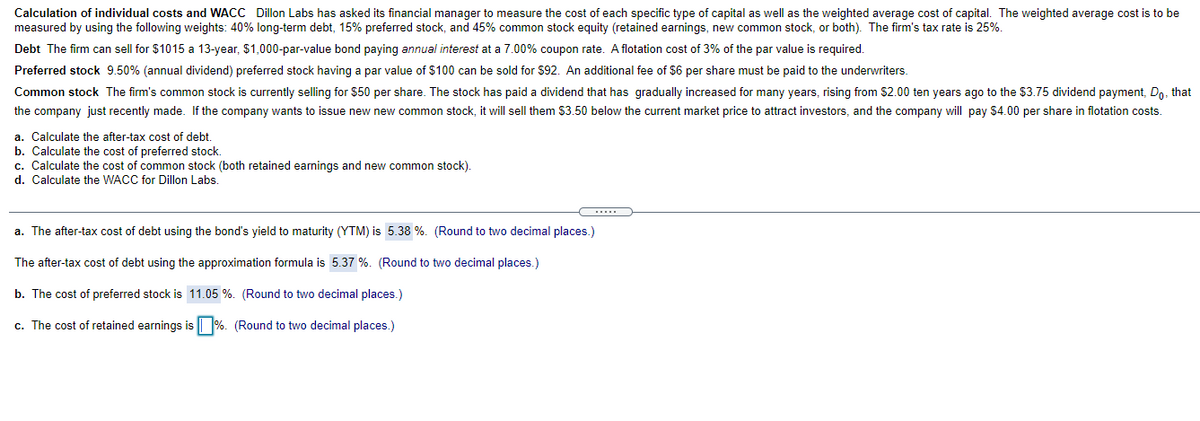

Answered Calculation Of Individual Costs And Bartleby

Sum the amount invested and shares bought columns.

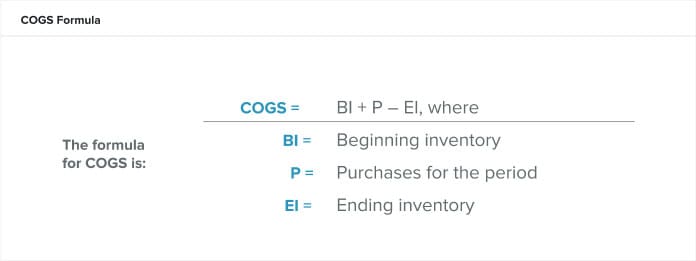

. Purchase Cost Purchases 5122220 We shall take the total raw material and labor cost for raw material as purchase cost which is 3233230. First we shall calculate the purchase cost. Essentially to get the cost of goods sold you add the beginning inventory and the additional inventory costs then subtract the ending inventory value.

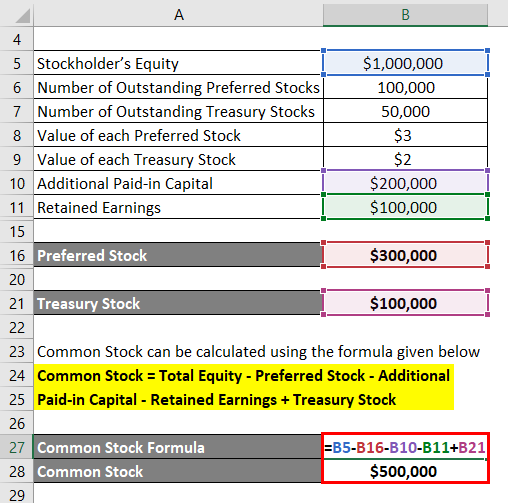

If the company splits its shares this will affect your cost basis per share but not thTake the original investment amount 10000 and divide it by the new number. The first in first out method would use the 100 per share you paid back in March to calculate your cost basis for any shares you sell. Book value per share Stockholders equity Total number of outstanding common stock For.

Dividing 4100 by 100 yields an average cost per share of 41. Suppose the brokerage is represented in percentages as 004 for intraday and 04 for delivery. For example if you own three shares in the Stock Basis Calculator.

The shares that you buy through dividend. Firstly you should know the number of stocks you bought and the price per stock you brought. Then Intraday brokerage Number of shares X Market Price of shares X 004.

Divide the total amount invested by the total shares bought. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the price you paid to exercise the option if both of these are true. In this example multiply 100 by 10 to get 1000 multiply 200 by 7 to get.

Evaluating Stock Performance This calculation is the first step in using the average cost basis method for determining gains or. Then please enter the input box as asked in the calculator and calculate it by. Multiply the number of shares in each transaction by its purchase price.

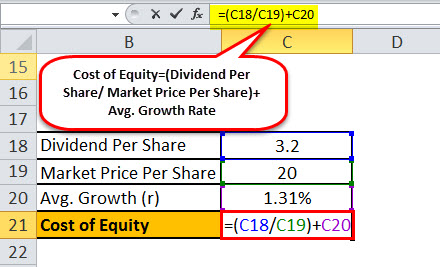

150 x 5 - 100 x 5 250 The. The plan was an incentive stock. Please calculate the cost of common stock by using the dividend discount model.

Buy low and sell high is one of the most fundamental rules of stock investing. Knowing the cost basis of the stocks you purchase can help you estimate your potential profit. Delivery brokerage Number of shares X Market Price of shares X 04.

You can also figure out the average purchase price for. The formula for calculating the book value per share of common stock is. Take your previous cost basis per share 10 and divide it by the split factor of 21 However if the companys share price has fallen to 5 and you want to i See more.

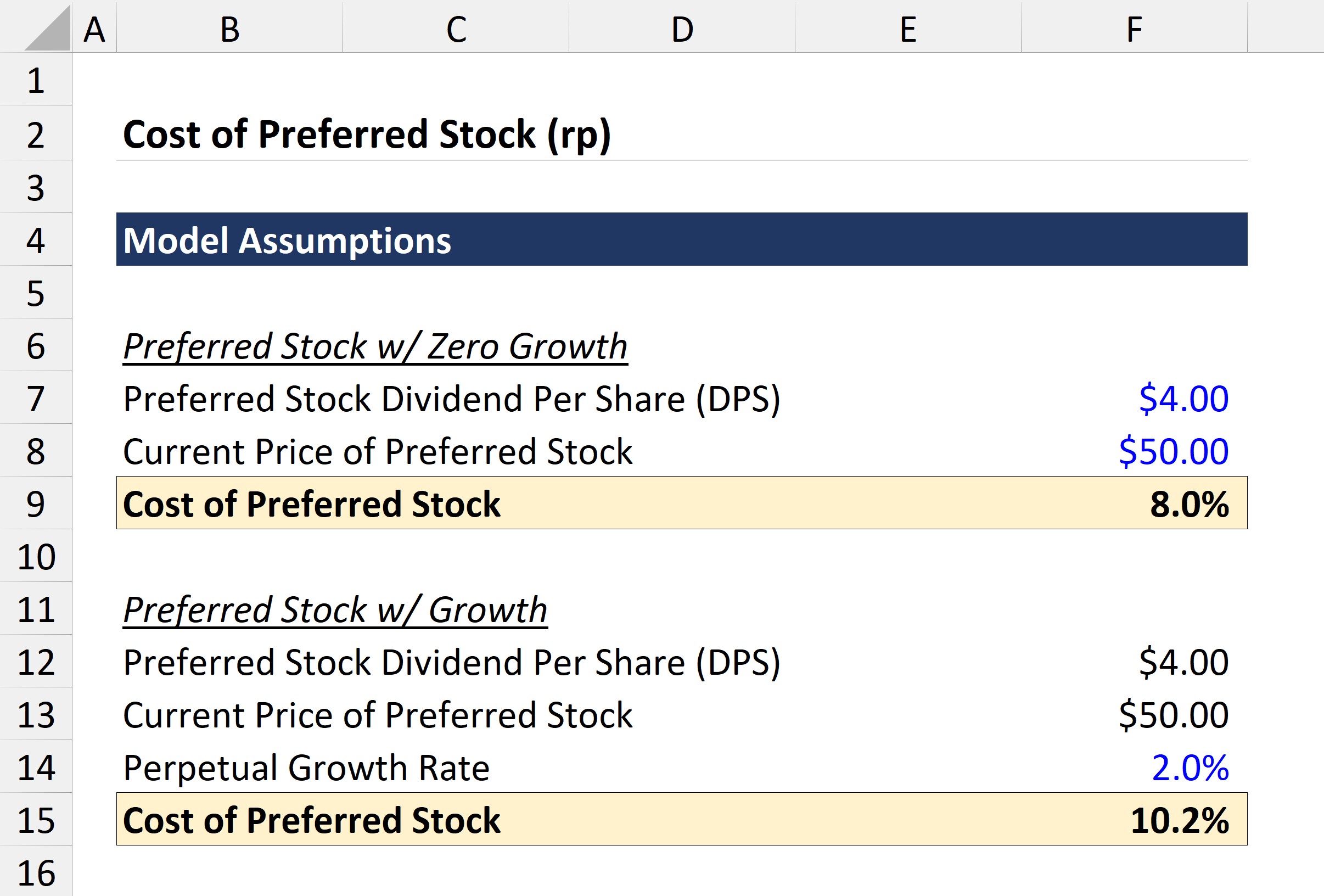

First we need to calculate the growth rate. Brokerage calculation formula. The formula used to calculate the cost of preferred stock with growth is as follows.

To calculate the cost of multiple shares purchased simply add the individual cost basis for each share you own. Rp 400 1 20 5000 20 The formula above tells us that the cost of preferred stock is equal to. Calculate Your Total Cost.

To calculate your profits for tax purposes youll need to subtract your cost basis for the five shares from the sale price of the five shares. The benefit of having to pay tax on your current dividend income is that you get to increase the tax basis of your position in the dividend stock. The general formula for.

Dividend Yield Definition Formula Investor Application

How To Calculate The Cost Of Preferred Stock Universal Cpa Review

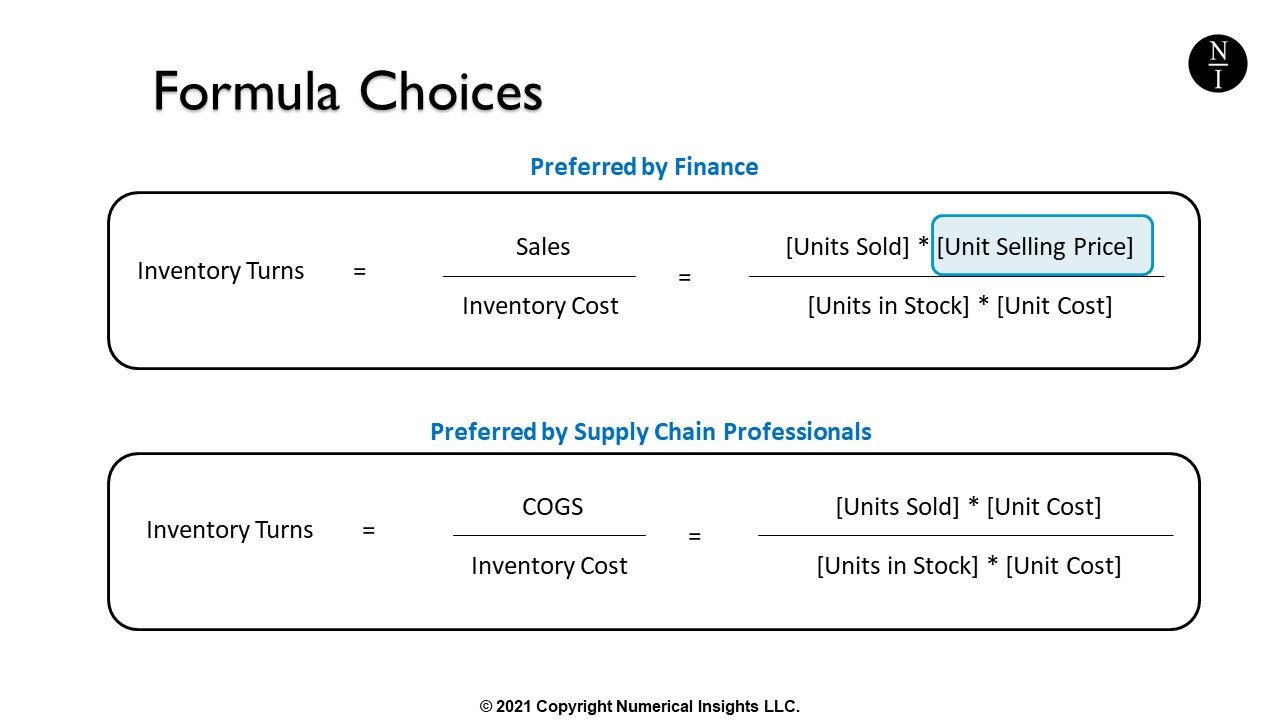

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Formula To Calculate Inventory Turns Inventory Turnover Rate

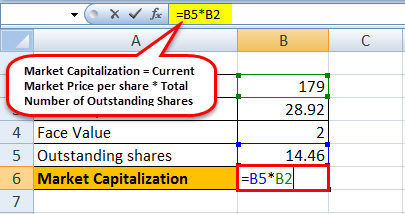

Market Capitalization Formula How To Calculate Market Cap

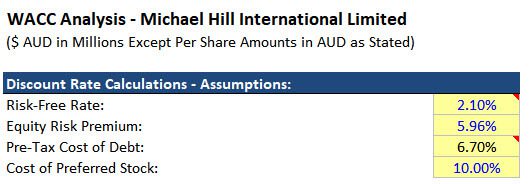

Step By Step Tutorial For Calculating Weighted Average Cost Of Capital Wacc Stockbros Research

How To Calculate Cost Of Preferred Stock Step By Step Tutorial

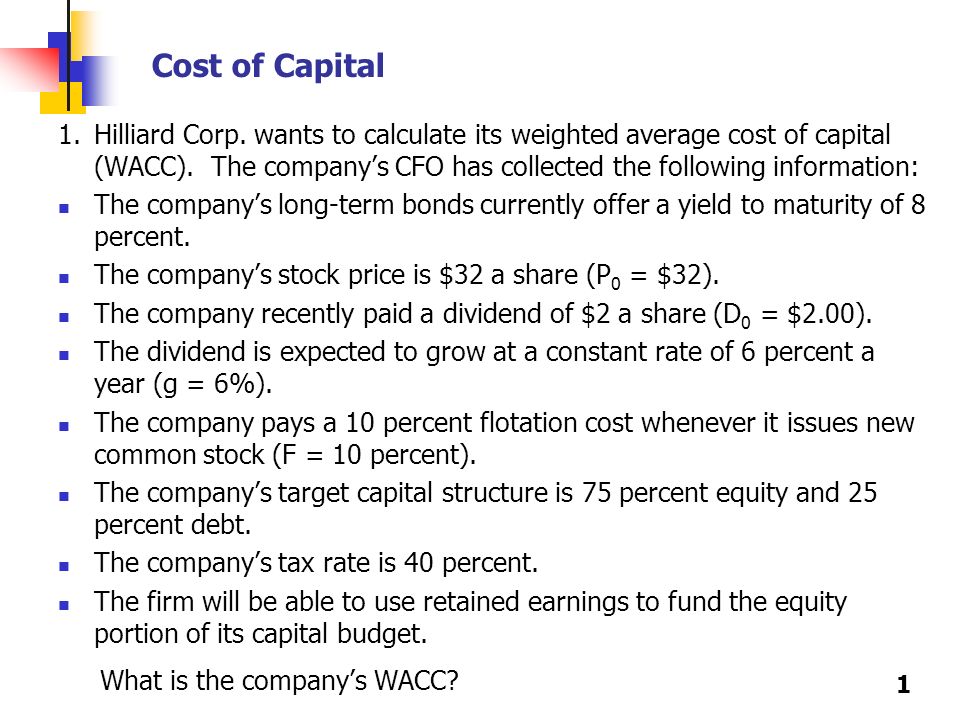

Cost Of Capital 1 Hilliard Corp Wants To Calculate Its Weighted Average Cost Of Capital Wacc The Company S Cfo Has Collected The Following Information Ppt Video Online Download

How Is The Average Price Calculated Timetotrade

How To Calculate Discount Rate In A Dcf Analysis

Periodic Inventory System Methods And Calculations Netsuite

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Cost Of Preferred Stock Detail Definition Formula Calculation Example Business Education

How To Calculate The Issue Price Per Share Of Stock The Motley Fool

5 Inventory Costing Methods To Consider When Valuing Your Stock Vend Retail Blog

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)