how to avoid paying nanny tax

You dont have to be audited in order to be caught by the IRS. The Social Security Administration.

Nanny Tax Salary Guide Nanny Lane

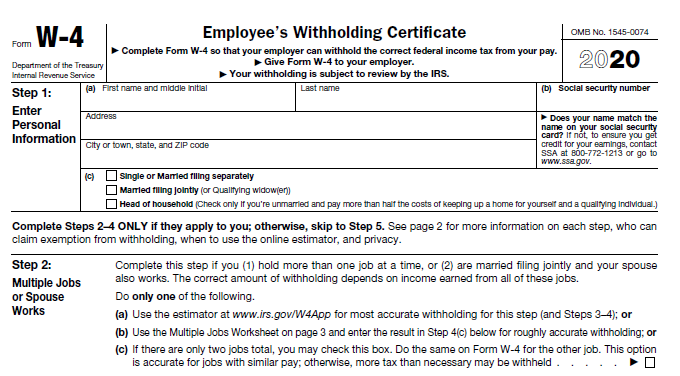

These taxes are collectively known as FICA and must be withheld from your nannys pay.

. Along with having a nanny though comes the added responsibility of nanny payroll and handling nanny taxes if you paid them more than 1900 in 2015 or more than. Complete Form W-2 Wage and Tax Statement and Form W-3 Transmittal of Wage and Tax Statements. You generally must pay unemployment tax on the first 7000 of wages you pay each household employee.

But 600 a week gross is in the range of 500 per. Form W-2 must be. Reducing your overall taxable.

Paying or Avoiding the Nanny Tax By Sue Shellenbarger. If your employee files for unemployment benefits after her employment with you ends and you havent paid your state. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return.

Social Security taxes will be 62 percent of your nannys gross before taxes. Parents who hire a babysitter and pay nanny taxes can claim child care credit. Simply divide your nannys total annual salary by 12.

Is it illegal to pay nanny in cash. The unemployment tax is 62 percent of your employees FUTA. The goal here is to avoid doing something stupid that will trigger an IRS audit ignite tabloid headlines or generate an exorbitant bill from the IRS for back taxes and penalties.

The 2022 nanny tax threshold is 2400 which means if a. If its 600 net after taxes thats around 710-750 gross assuming the basic claim amounts depending on the province. By paying nanny taxes an employer running a business can avoid legal notice.

Its no secret that businesses have the most leverage when it comes to tax credits tax deductions or tax write-offs. Some of the richest. This will equal the nannys gross monthly wages before federal and state taxes are withheld.

The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount. Complete year-end tax forms. 5 2008 123 pm ET Reporting this weeks Work Family column on how fewer parents are paying nanny taxes.

Become a Business Savant. It builds a good relationship. Complete and submit wage and tax forms.

Paying cash Paying your nanny cash is perfectly ok so long as all the tax requirements and super requirements are also met and there is a payslip detailing. This lets you set aside up to 10500 of your annual income before taxes and then use that money to pay for child care expenses such as your nannys wages. If your nannys salary is.

3 Ways To Pay Nanny Taxes Wikihow Life

How To Avoid The Nanny Tax Maid Service Faqs

How To Pay A Nanny The Right Way Nanny Taxes Paperwork And More

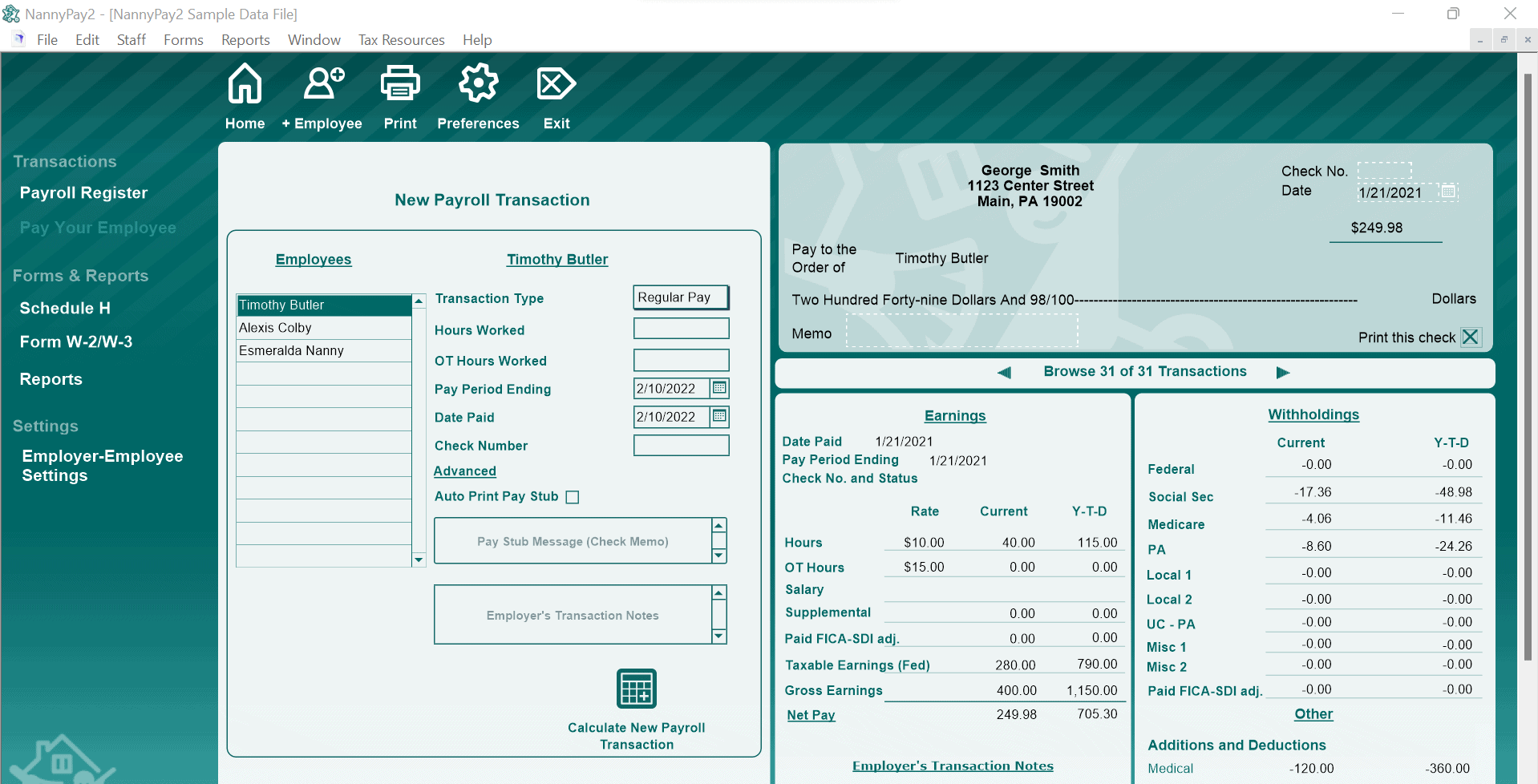

The 8 Best Nanny Payroll Software 2022

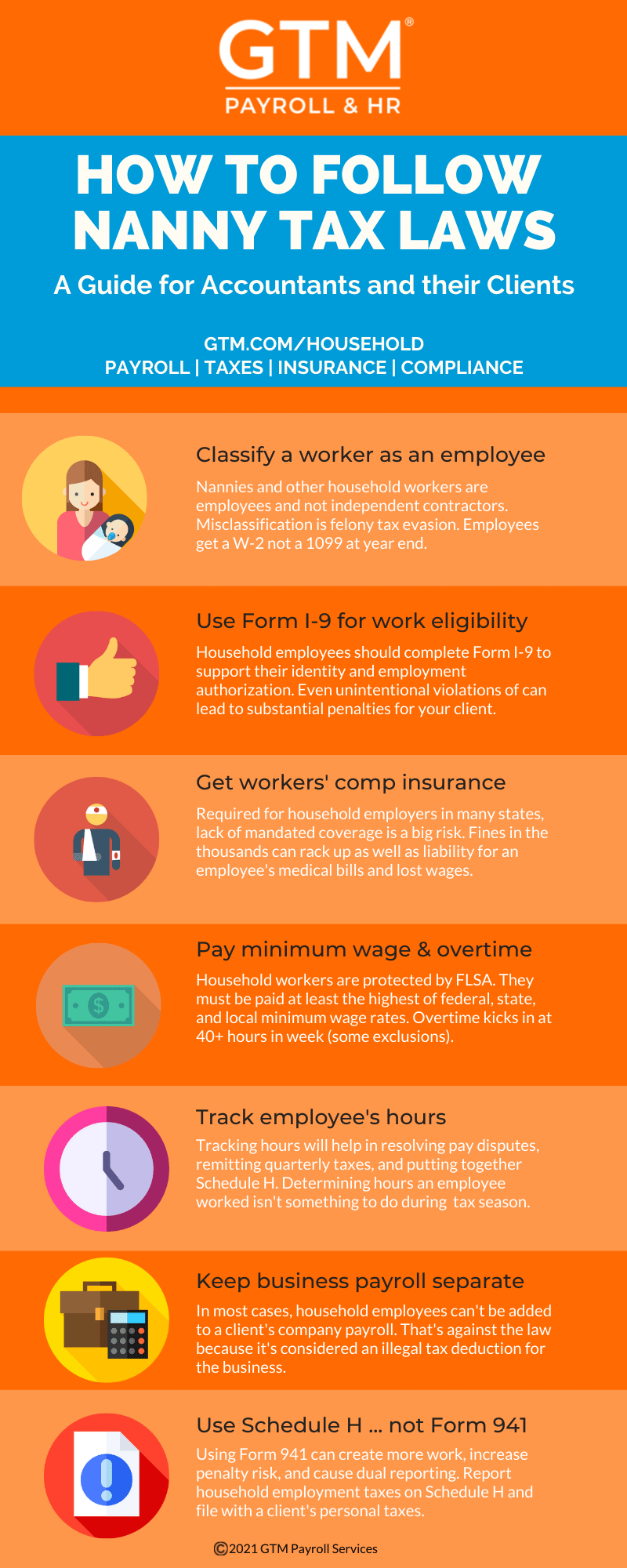

A Guide To Nanny Tax Compliance For Accountants And Their Clients

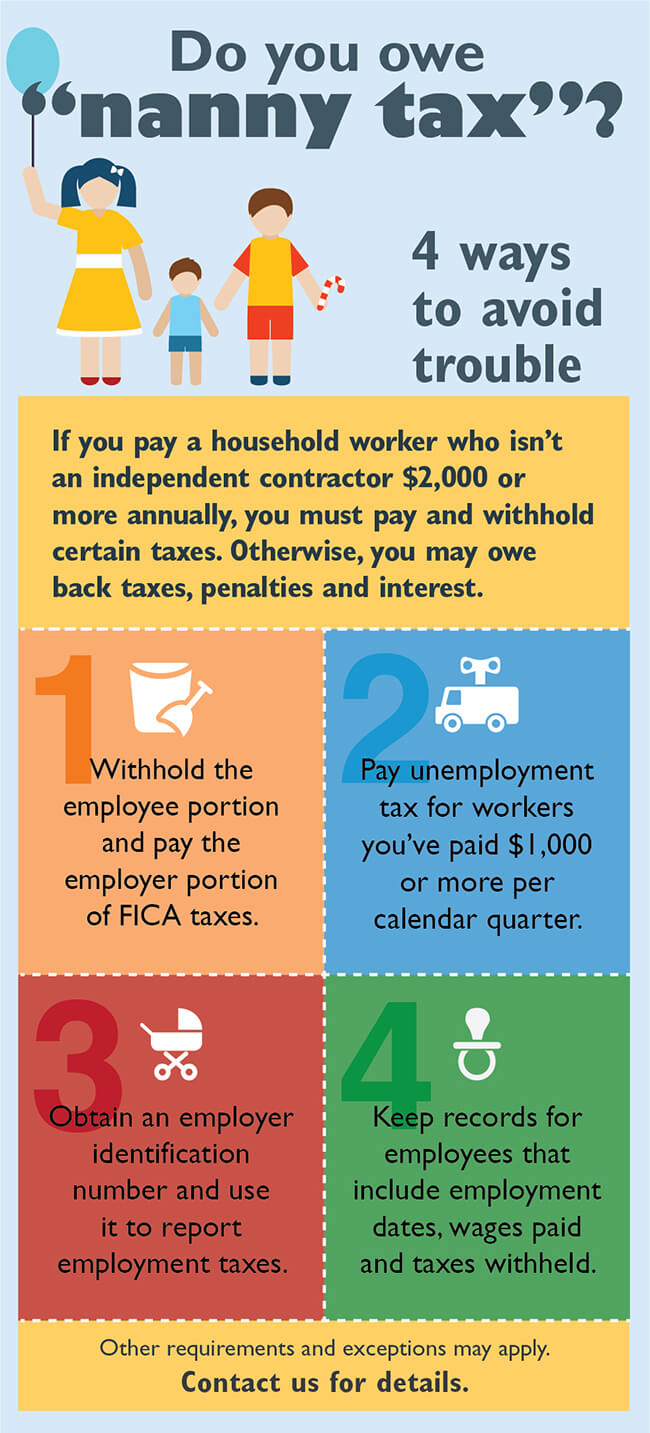

Do You Owe Nanny Tax Yeo And Yeo

How Do Nanny Taxes Work They Re Complicated But Skipping Them Is A Mistake Marketwatch

Guide To The Nanny Tax For Babysitters And Employers Turbotax Tax Tips Videos

The Right Time To Put A Nanny Or Caregiver On The Books Hws

How To Lower Nanny Tax Expenses Through Tax Credits Nanny Tax Tools

The Abcs Of Household Payroll Nanny Taxes

How To Pay Your Nanny Legally In 2022

Guide To Household Employment Payroll Taxes Hws

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Payroll Services For Households Adp

How To Pay Nanny Taxes Yourself

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Does The Household Employee Tax Apply To Me And What To Do Mark J Kohler

Should I Pay Taxes On My Nanny Georgia S Dream Nannies Atlanta Nanny Service Palmetto Bluff Nannies Bluffton Nanny Service Hilton Head Nannies South Carolina Nanny Agency